Iraq & The Kingdom Of Saudi Arabia’s Business Prospects

IFPMC-LONDON

MAY 2024

![]()

read more:

Iraq and the Kingdom Of Saudi Arabia’s business prospects

Investment between Iraq and Saudi Arabia has significantly increased, marking a notable relationship shift over the last five years. Saudi Arabia has announced multiple investments across various sectors in Iraq, valued at over $5 billion, with the majority focused on the real estate sector in Baghdad. This move reflects a broader trend where Gulf Cooperation Council (GCC) countries, including the UAE and Qatar, are also increasing their investments in Iraq, particularly in real estate projects.

Saudi Arabia’s most significant investment project in Iraq, known as the “Baghdad Avenue” project, involves a $1 billion investment near Baghdad’s airport, featuring the largest mall in Iraq, along with 4,000 apartments and 2,500 villas. This project underscores the scale and ambition of Saudi Arabian investments in Iraq. Additionally, the Saudi Public Investment Fund has established a new unit dedicated to investment in Iraq, with a capital of $3 billion, focusing on sectors such as infrastructure, mining, agriculture, real estate development, and financial services. This initiative is part of a broader strategy by Saudi Crown Prince Mohammed bin Salman to establish regional companies targeting investments in several countries, including Iraq[1].

- Iraq Economic Indicators

Iraq’s economy suffered a severe blow from COVID-19, lower global oil prices, and OPEC output quotas. The GDP shrank by an estimated 15.7% in 2020 but rebounded to 7.7% in 2021 and 7% in 2022. The real non-oil GDP is projected to have expanded by 6% in 2023. However, the overall GDP growth rate was estimated to be negative at 2.7%. The non-oil growth is expected to continue into 2024, stabilizing around 2.5%. The IMF projects an overall increase of 2.9% in 2024 and 4% in 2025. The fiscal balance declined from a surplus of 10.8% of GDP in 2022 to a deficit of 1.3% in 2023 due to lower oil revenues and increased expenditures. The fiscal deficit is expected to reach 7.6% in 2024, and public debt is projected to almost double by 2029[2]. The government needs to focus on fiscal adjustment, public financial management, and mitigating budgetary risks. Inflation dropped from 7.5% in January 2023 to 4% by the end of the year, and the current account is anticipated to have a surplus of 2.6% of GDP. According to the IMF, Iraq needs more sustainable non-oil growth to address unemployment, poverty, and low GDP per capita. The unemployment rate was 15.3% in 2022, and the poverty rate has risen to 25%. The GDP per capita is estimated at USD 10,865 in 2022[3].

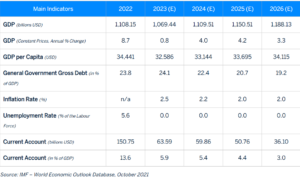

- KSA Economic Indicators

Saudi Arabia has the largest economy in the Middle East is the most prosperous Arab country. The economy is almost entirely based on oil, with GDP growth closely linked to real oil growth. The government reported a budget deficit in 2023 and anticipated deficits in the following years. Total expenditure rose in 2023 and is expected to slow down in 2024. The government aims to maintain fiscal discipline by reducing subsidies and capital expenditures. The total outstanding direct indebtedness stood at SAR 1,050.3 billion in December 2023, with an expected decrease in the debt-to-GDP ratio by 2025. Saudi Arabia boasts one of the highest standards of living in the Middle East, but the unemployment rate among Saudis rose to 8.6% in the third quarter of 2023.

The influx of investments from GCC countries, spearheaded by Saudi Arabia, the UAE, and Qatar, is a significant turning point in Iraq’s economic development. These investments promise to stimulate growth in critical sectors like real estate and drive the modernization and diversification of Iraq’s economy. However, the success of these ventures is contingent on overcoming challenges such as the effectiveness of the Iraqi banking system and ensuring political stability. These factors could impact the profitability and sustainability of these investments, underscoring the need for careful consideration and strategic planning[4].

3-IRAQ Foreign Trade in Figures

4-KSA Foreign Trade in Figures

Investment scopes between the KSA and Iraq

Besides real estate, Saudi Arabia has shown interest in investing in several other sectors in Iraq, as highlighted by establishing a new unit by the Saudi Public Investment Fund with a capital of $3 billion. This unit focuses on investments across various fields, including:

Infrastructure: Enhancing Iraq’s physical infrastructure through investments in roads, bridges, ports, and utilities to support economic growth and connectivity.

Mining: Expanding exploration and extraction activities in minerals such as oil, gas, and precious metals to boost Iraq’s natural resource-based industries.

Agriculture: Investing in agricultural projects to improve food security, increase crop yields, and develop irrigation systems.

Financial Services: Many projects are underway to establish partnerships and investments in banks and financial institutions, enhancing the financial sector’s capacity and efficiency in Iraq.

To facilitate these investments, the Saudi Public Investment Fund has also established a branch of the Saudi Arab Bank, named the Arabi Bank of Iraq. This move aims to streamline financial transactions and support the economic integration between the two countries.

- Healthcare: Investments in healthcare facilities and services can significantly improve the quality of life for Iraqis and reduce the strain on the public health system. This project includes the development of hospitals, clinics, and medical research centres, which are essential for promoting health and wellness in the population.

- Manufacturing and Technology: Investments in the manufacturing and technology sectors can spur innovation and competitiveness. This includes the development of industrial parks and technology hubs and promoting high-tech industries such as renewable energy, IT, and digital services. Such investments can create high-skilled jobs and contribute to technological advancement.

- Agriculture: Investments in agriculture can enhance food security, increase crop yields, and introduce modern farming techniques. This sector ensures the country’s food supply and reduces dependency on imported goods.

Establishing the Saudi-Iraqi Company and the Saudi Public Investment Fund’s new unit for investment in Iraq, with a focus on these sectors, signifies a strategic approach to diversifying Iraq’s economy. These investments are not just about economic growth but also about building a more sustainable and resilient economy that can thrive beyond the fluctuations of global oil prices.

impact on the local labour market

These investments reflect Saudi Arabia’s strategic approach to bolstering Iraq’s economy and enhancing bilateral ties, aligning with broader regional cooperation and economic development objectives.

The investments from Saudi Arabia and other Gulf Cooperation Council (GCC) countries in Iraq are expected to have a multifaceted impact on the local labour market in Iraq, potentially transforming it in several ways:

- Job Creation: The construction and development projects associated with these investments will likely create numerous job opportunities. Real estate, infrastructure, and mining projects require a large skilled and unskilled labour workforce. This investment could reduce unemployment rates and improve living standards for many Iraqis.

- Skill Development: As foreign investors bring in expertise and technologies, local workers may have opportunities to gain new skills and knowledge. These projects could lead to a more skilled workforce capable of handling future projects and contributing to the country’s economic development beyond the lifespan of these investments.

- Economic Diversification: Investing in various sectors could help diversify Iraq’s economy away from its traditional reliance on oil exports. A diversified economy is generally more resilient and can offer a broader range of employment opportunities.

- Increased Foreign Direct Investment (FDI): Saudi and other GCC investments could attract further FDI into Iraq, leading to a cycle of economic growth and development. These projects could result in even more job creation and economic activity.

- also established the Saudi-Iraqi Company, part of an initiative of Saudi Crown Prince Mohammed bin Salman to establish five regional companies targeting investments in Jordan, Bahrain, Sudan, Iraq, and Oman.

- Official figures and statistics indicate that trade between Iraq and Saudi Arabia grew by 50% between 2021 and 2022, totalling $1.5 billion.[5].

- Potential Challenges:

-

- Local Capacity Building: Local businesses and workers need to build capacity to meet the demands of international standards and practices.

-

- Competition for Jobs: While jobs are created, competition for these positions could intensify, especially if there is a mismatch between the skills offered by the local workforce and those required by the projects.

Overall, while these investments promise to improve the local labour market in Iraq, it’s crucial that the benefits are distributed equitably and that efforts are made to ensure that local workers are adequately prepared to take advantage of the opportunities presented.

barrier

Challenges and concerns have been raised regarding Saudi Arabian investments in Iraq’s infrastructure and other sectors. Some of these concerns include:

- Political Opposition: Despite the potential economic benefits, there is opposition within Iraq to Saudi Arabian investments, primarily driven by political reasons. This opposition must be navigated carefully for the investments to be successfully implemented.

- Effectiveness of the Iraqi Banking System: One of the critical challenges identified is the effectiveness of the Iraqi banking system. An ineffective system could pose problems for financial transfers and overall investment management. Ensuring the development of an effective banking system is crucial for the success of these investments.

- Security Concerns: There are ongoing concerns about the country’s safety and stability, which could affect the execution and sustainability of the projects. Political instability and the influence of militias could pose risks to the investments, especially if they are perceived as hostile towards Saudi and Gulf interests.

- Political Messages and Dominance Perception: Some observers suggest Saudi Arabia’s investments in Iraq carry political messages, indicating its dominance in the Middle East. This perception could complicate diplomatic relations and the Iraqi public’s and other stakeholders’ acceptance of the investments.

Despite these challenges, the investments are progressing, with many agreements fully implemented. Efforts are being made to address these concerns, including direct oversight by the Iraqi Prime Minister’s Office and the Investment Authority. The success of these investments will depend on navigating these challenges effectively and ensuring that the benefits are widely shared among the Iraqi population.

Reference

[1]- Arab News, May 25(2023), Saudi Arabia’s PIF announces $3bn investment unit for Iraq, https://arab.news/9ze8s

2- U.S. Department Of State ,2023 Investment Climate Statements In Iraq , Iraq – United States Department of State

- 2021 .World Economic Outlook Database, World Economic Outlook, October 2021: Recovery During A Pandemic (imf.org)

Hudhaifa Ebrahim, Iraq Attracts Wave Of Saudi And Gulf Investment For The First Time ,The Medialine ,Mondy 06\10\2024 Iraq Attracts Wave of Saudi and Gulf Investments for the First Time – The Media Line

[1] Arab News, May 25(2023), Saudi Arabia’s PIF announces $3bn investment unit for Iraq, https://arab.news/9ze8s

[2] U.S. Department Of State ,2023 Investment Climate Statements In Iraq , Iraq – United States Department of State

[3] IMF.2021 .World Economic Outlook Database, World Economic Outlook, October 2021: Recovery During A Pandemic (imf.org)

[4] IMF.2021 .World Economic Outlook Database, World Economic Outlook, October 2021: Recovery During A Pandemic (imf.org)

[5] Hudhaifa Ebrahim, Iraq Attracts Wave Of Saudi And Gulf Investment For The First Time ,The Medialine ,Mondy 06\10\2024 Iraq Attracts Wave of Saudi and Gulf Investments for the First Time – The Media Line